Case Study

Study 1 - HMRC tax investigation

Minervise has helped one of the overseas clients to successfully claim roughly 500,000 GBP VAT from HMRC after two years' dispute with its previous accountant who has messed up the accounts and VAT claim with HMRC.

Study 2 - Consolidation between UK and Chinese GAAP

One of Minervise's major clients is China based that has investment in the UK. This client is regulated by the State-Owned Assets Supervision and Administration Commission of China (SASAC). Required by SASAC, this client needs to adopt UK GAAP for accounts in the UK but Chinese GAAP when reporting to the SASAC. Minervise has managed to find a solution for the accounts to be fully complied with both the UK and Chinese GAAP with consistent figures and presentations.

Study 3 - Pricing Strategy

Minervise has successfully helped a client choose the most appropriate pricing model to launch a new product overseas taking into account the marketing position, local demand, environmental and competition factors, which enabled the client penetrate the new market and gain loyal customers with maximised profit.

Study 4 - Risk Management

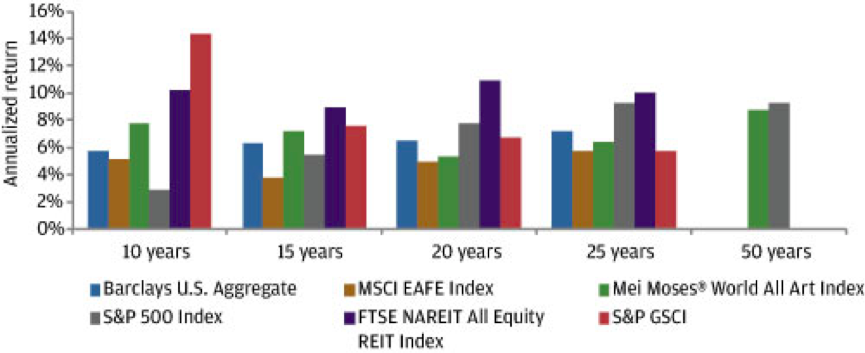

Minervise has advised an Art Investment Fund with proper risk management method by reducing the potential volatility of 30% whereas more attractive than some mainstream investment funds.

Study 5 - Set Up Finance Function

Minervise has helped a multinational Chinese investor set up the new Finance Department and Functions after merger and acquisition with a UK entity.

- Budgeting and Forecast

- Cost/Expenditure Analysis and Control

- Procurement Procedures and New Suppliers Bidding

- Employment Review and Rewarding Scheme

- Revenue Cycle Review and New Invoicing Procedures

- Daily Management and Finance Information System Screening and Set up

- Fixed Assest Management

- New Investment/Projects Management

- Potential Merge and Acquisition Due Diligence Check